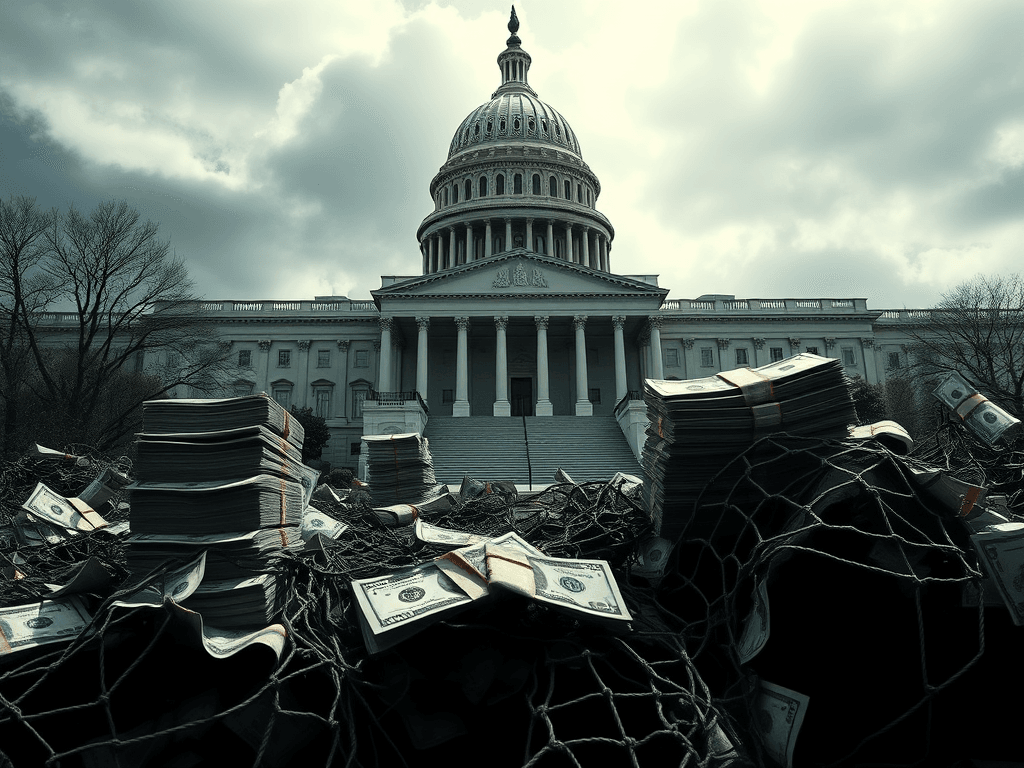

Alright, team ‘Critical Defiance,’ let’s dive into something that’s going to hit all of us right in the wallet, and possibly, right in the gut: President Trump’s recently passed budget and policy bill, affectionately (or perhaps, ironically) dubbed “The One Big, Beautiful Bill Act.” Because nothing says “beautiful” like potentially gutting social safety nets, right?

This legislation, which just squeaked through Congress, is a real doozy, and its consequences are set to ripple through American society for years to come. So, let’s break down what’s in this “beautiful” package and what it truly means for the future of our nation.

Tax Cuts for the Wealthy, Again. Shocking.

First up, the tax policy. Remember the 2017 tax cuts? Good times, if you were already swimming in cash. Well, this new bill makes those permanent. And it throws in some new tax breaks on tips and overtime, plus a boosted standard deduction. Sounds nice on the surface, right? A little something for the “working class.” But let’s be real, the main thrust here is making sure those at the very top continue to enjoy a significantly lower tax burden. Independent analyses, like those from the Congressional Budget Office (CBO) and others, consistently show that the lion’s share of these tax benefits flows straight to the wealthy. We’re talking about a multi-trillion-dollar tax cut that predominantly benefits corporations and the ultra-rich. Source: Newsweek, Common Dreams

The Safety Net Gets a Serious Shredding

Now, for the really concerning part: the deep cuts to vital social programs. This bill includes major reforms to Medicaid and the Supplemental Nutrition Assistance Program (SNAP), often referred to as food stamps.

- Medicaid: We’re looking at an estimated $1 trillion in cuts over the next decade, potentially leaving millions without health coverage. The bill introduces new work requirements for able-bodied adults aged 19-64 (80 hours a month of work, volunteering, study, or training, with some exemptions), more frequent eligibility reviews, and even potential out-of-pocket costs. Plus, federal funding to states for Medicaid is set to shrink significantly by 2028. This is a massive shift, pushing the burden onto states that are already struggling to balance their budgets. As the president and CEO of the Greater Boston Food Bank, Catherine D’Amato, stated, “These cuts are the largest in history, reducing or eliminating benefits for seniors, Veterans, children, legally-present immigrants, and working families. This Act shifts responsibility of paying for food and health care programs onto individual states—a burden that no state budget will be able to absorb without significant trade-offs to other critical state-funded social needs programs.” Source: Newsweek, New America

- SNAP: Similar work requirements are being imposed on SNAP recipients, which could lead to millions losing essential food assistance. For the first time, states with high error rates in SNAP distribution will also be on the hook for a percentage of the costs. Imagine trying to feed your family when your income is already stretched thin, and now the safety net is being pulled out from under you. Source: Newsweek

Student Loan Shenanigans and Environmental Setbacks

But wait, there’s more! The bill also takes aim at student loans, eliminating popular repayment plans like SAVE and Income-Contingent Repayment, replacing them with less flexible options. Graduate PLUS loans are also on the chopping block, replaced with borrowing caps. For anyone trying to navigate the already treacherous waters of higher education debt, this is a significant blow. Source: Newsweek

And if you care about the planet (which, as liberals, we absolutely do), this bill is a gut punch to clean energy initiatives. It cuts federal tax credits for electric vehicles and energy-efficient homes, and restricts programs aimed at limiting carbon emissions. Some even call it “the most anti-environment and anti-climate bill in history.” Source: OPB

The Elephant in the Room: The National Debt

Perhaps the most significant long-term consequence of this “Big, Beautiful Bill” is its impact on the national debt. The CBO projects it will add an astonishing $3.4 trillion to the federal deficit over the next decade. This is happening at a time of relative economic stability, not during a recession or crisis. As Wall Street figures and economists are warning, this is a fiscal time bomb. We’re already seeing the debt-to-GDP ratio soaring, and this bill will only accelerate that trend. What does that mean for you and me? Higher interest rates, which means more expensive mortgages, car loans, and student loans down the line. And less fiscal space for the government to respond to future emergencies. Source: Times of India, PIIE

The Future of America?

So, what does this all mean for the future of America? Well, if we’re being honest, it paints a pretty stark picture. We’re looking at a future where:

- Wealth inequality deepens: The rich get richer, and the burden on working and middle-class families increases.

- Access to essential services dwindles: Healthcare and food assistance become harder to access for millions of vulnerable Americans.

- States bear the brunt: Without federal support, states will struggle to maintain crucial programs, potentially leading to widespread cuts in services.

- The national debt balloons: This could lead to higher interest rates, slower economic growth in the long run, and less capacity to address future challenges.

- Environmental efforts are stifled: Our commitment to addressing climate change is severely undermined, with long-term consequences for the planet and future generations.

This “One Big, Beautiful Bill” might be beautiful to some, but for many Americans, it looks more like a recipe for a more unequal, less secure, and environmentally threatened future. It’s on us, the defiant ones, to understand these policies, their consequences, and to hold our elected officials accountable. Because American freedom isn’t just about what’s written on paper; it’s about the tangible ability of every individual to thrive.

Leave a Comment